By Miva | December 3, 2021

See why top ecommerce brands use Miva’s no-code platform to run

multiple stores, manage massive catalogs, and grow their revenue.

The modern online shopper expects a fast, convenient, and safe checkout experience equipped with advanced payment technology. Failing to meet these expectations can cost ecommerce sellers in both sales and reputation.

There are plenty of payment technologies and solutions available to ecommerce businesses, but it can be difficult to nail down exactly which ones are right for your online store. In this article, we’ll take a look at the different kinds of payment technology available to merchants and explore the benefits of each.

In ecommerce, payment technology involves the tools, processes, and infrastructure that facilitate digital payments—the electronic transfer of money from one account to another as part of an online purchase. Payment technology can include solutions like payment gateways, alternative checkout methods like digital wallets and mobile payment apps, buy now pay later financing options, and more.

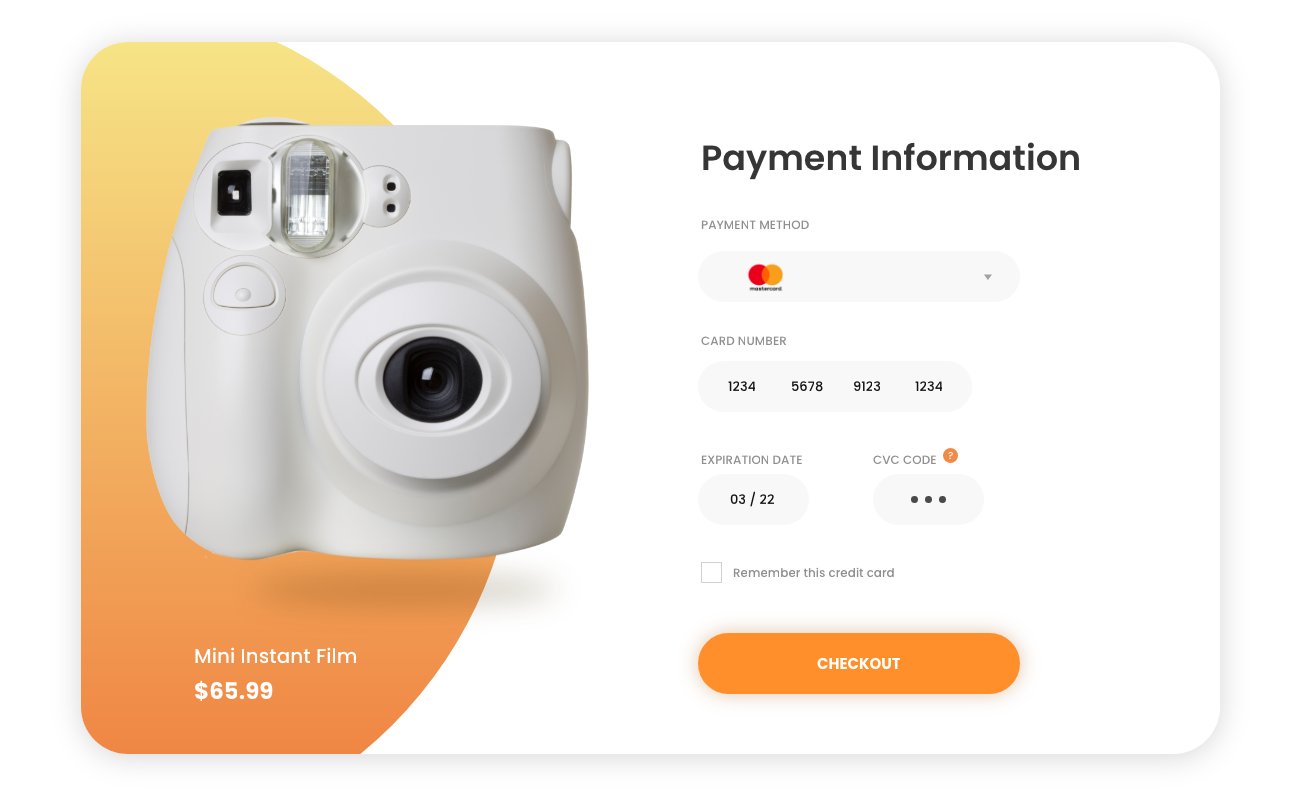

To accept direct credit card payments on your site, you’ll need both a payment gateway and a merchant account. When a buyer makes a purchase from your online store, the payment gateway authorizes the transaction, while the merchant account receives and holds the payment before it lands in your bank account. A robust payment gateway enables you to offer your customers several different payment options (credit cards, debit cards, electronic checks, and more), giving them the ability to use their preferred payment method.

You can get these two payment technologies from different vendors or you can opt for an all-in-one payment gateway that provides both services. The advantage of an all-in-one solution is the ability to pay one low rate to a single vendor for your gateway and account services. Having your payment gateway and merchant account supported by different vendors means separate—and potentially greater—processing fees, but may be preferable if your payment gateway doesn’t accept payments for some of your products.

A credit card vault is a payment technology that encrypts and securely stores your customers’ credit card information. Vaults allow online sellers to accept credit card payments without having to handle and store card information themselves, reducing liability exposure and simplifying PCI compliance. Credit card vaults make payments easier and more convenient for customers, allowing them to reuse their stored and encrypted payment methods via a secure digital wallet.

Miva considers a secure credit card vault to be an essential part of a full-featured ecommerce platform. This is why MivaPay, Miva’s powerful payment vault solution, comes standard with Miva.

One-click payment technology gives customers the option of saving the data that they enter on the checkout page. Then, when the shopper makes a future purchase at the same store, the payment system fills in the shopper’s data automatically and allows them to securely place an order with the same payment details. This creates a frictionless and convenient buying experience for your customers.

An alternative checkout is an online checkout process that allows shoppers to use third-party payment methods instead of traditional payments like credit cards and electronic checks. Alternative checkouts can smooth your customers’ path to purchase by giving them the freedom to use whichever payment method is most convenient. There are different types of alternative payment methods, including digital wallets, mobile app payments, and crypto wallets.

A digital wallet is a payment technology that holds a shopper’s payment information directly on their phone, computer, or other electronic device. Digital wallets simplify the payment process by securely managing everything from credit cards to rewards cards to memberships.

Mobile app payment technology enables shoppers to send money to businesses or individuals using the app on their device. Some mobile payment apps are linked to the user’s bank account, while some are funded directly.

Some online sellers, especially B2B merchants and retailers offering “big ticket” products, may improve purchase completion rates by offering ecommerce financing, credit, and buy now pay later (BNPL) options during checkout.

Financing, credit, and BNPL solutions are becoming increasingly popular among today’s shoppers. This payment technology allows customers to pay for their purchases over time in several interest-free installments, providing them with increased flexibility and convenience. Merchants who offer buy now pay later options may drive online sales, boost average order values, and reach new customers.

See Ecommerce Financing and Credit Solutions

Ideally, you should try to offer your customers as many diverse payment options as possible. Doing so can help clear up common objections and minimize friction points during the shopping and checkout processes. The right payment technologies for your ecommerce site are the ones that will make your customers’ purchasing experience as easy, convenient, and safe as possible.

Fraud and other forms of cybercrime are a top concern for many online merchants these days. Fortunately, there are plenty of security solutions available that can help you protect your business and customers.

See Fraud Prevention Solutions

Types of Ecommerce Fraud to Look Out For

We partner with the best to ensure that our clients have the stability and security they need to be successful. This standard is the foundation of our expansive ecosystem of payment partners, whose technologies integrate seamlessly with the Miva platform.

Our Preferred Partners offer payment technologies such as payment processing, fraud prevention, alternative checkout, and financing solutions (pay-over-time credit and buy now pay later options) to meet the needs of every business.

Braintree is an all-in-one solution for accepting and processing ecommerce payments. Braintree delivers an innovative payment experience with advanced security, digital wallet functionality, and more.

Authorize.Net, a Visa solution, provides secure, reliable payment gateway solutions. These solutions help merchants simplify PCI compliance, prevent fraud, accept alternative digital payments and electronic checks, and protect customer payment information.

Authorize.Net can be used as a gateway alongside a merchant account supported by another vendor.

Chase offers secure and reliable payment processing solutions that help merchants improve how they run and grow their businesses. Key features include comprehensive reporting tools, chargeback management, fraud prevention, and 24/7/365 in-house customer support.

Square helps businesses easily sell online and in person by providing greater payment flexibility for customers and creating more conversion opportunities for ecommerce sellers. Key features include fraud detection, chargeback protection, and real-time sales data.

REPAY is an all-in-one payment provider that offers omnichannel B2C and B2B integrated payment solutions, low credit card processing rates, simplified PCI compliance, and level 3 credit card processing for online sellers.

MivaPay is a secure credit card vault that works with your payment gateway to simplify PCI compliance and protect your customers’ payment information.

Signifyd leverages machine learning and big data to shift fraud liability away from merchants, helping them increase sales and revenue.

Kount’s AI-driven fraud protection solution helps merchants reduce chargebacks, accept more legitimate orders, and prevent mobile fraud.

PayPal checkout is an alternative checkout service that enables merchants to accept credit card, debit card, and PayPal payments on their websites.

Amazon Pay is an alternative checkout solution that offers customers a trusted and recognizable checkout using information stored in their Amazon account.

Apple Pay gives customers using Mac computers, iPhones, Apple Watches, and iPads the convenience of single-touch purchasing.

PayPal Credit offers merchants an easy way to extend financing options to customers, boosting sales and increasing average order size.

Affirm offers a pay-over-time solution designed to help improve customer experience and increase conversions. Affirm offers flexible payment options and assumes all chargeback and fraud risk.

Apruve provides a simple way to extend net terms to business buyers, providing risk-free payment in 24 hours.

Credit Key allows B2B merchants to offer an instant buy now pay later function that is seamlessly integrated at checkout. Credit Key’s proprietary process facilitates lightning-fast financing approval that is unique in the B2B space.

Rumbleship enables auto-debit invoicing for merchants to allow risk-free net terms for wholesale buyers.

UPS i-parcel offers a complete solution for international shipping, providing total landed cost during checkout, currency conversion, fraud protection, and international payment options.

Zonos helps merchants connect with and better serve international shoppers. Key features include clear duties, accurate international shipping rates, and localized currency.

Miva works with the best ecommerce solutions and providers to help online sellers build an ecosystem that works for their business. Learn more.

This blog was updated on June 9, 2022.

Love it? Share it!

No worries, download the PDF version now and enjoy your reading later...

Download PDF Miva

Miva

Miva offers a flexible and adaptable ecommerce platform that evolves with businesses and allows them to drive sales, maximize average order value, cut overhead costs, and increase revenue. Miva has been helping businesses realize their ecommerce potential for over 20 years and empowering retail, wholesale, and direct-to-consumer sellers across all industries to transform their business through ecommerce.

Visit Website